1

Please refer to important disclosures at the end of this report

1

1

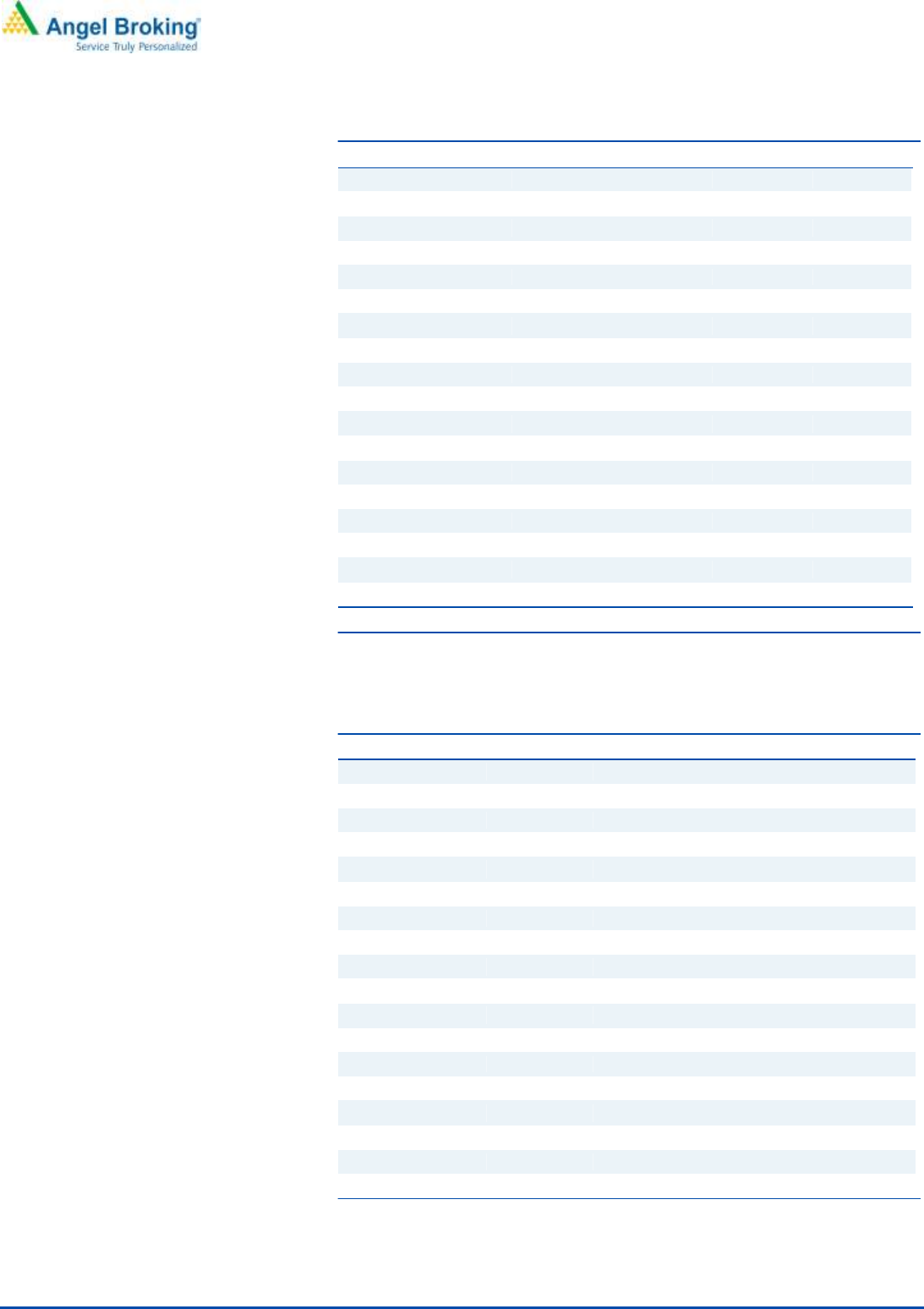

Quarterly Summary:

Y/E March (` cr)

Q 2FY20

Q 2Y19

% yoy

Q 1FY20

% qoq

Revenue

9,620

9,249

4.0

11,405

(15.6)

EBITDA

1,918

1,421

35.0

2,950

(35.0)

OPM (%)

19.9

15.4

450bps

25.9

(600 bps)

Adjusted PAT

579

356

63

1,281

(55)

Source: Company, Angel Research (All the above numbers are inclusive of Century cement).

Century Cement merged with Ultratech: In Q2FY20, consolidated revenue,

EBIDTA, PAT grew by 4%, 35% and 62.6% YoY respectively (including impact of

Century Cement in both the quarters). Operating margin also improved by 5%

YoY due to better realizations & cost control. Company reported `1055 EBIDTA/

tonne compared to `776 EBIDTA/tonne in Q2FY19.

Favourable Cost trends & debt reduction: Logistics cost declined 8% YoY to

`1,111. Energy cost as well as raw materials costs also declined by 9% & 2% YoY

to `1003 & `495 respectively. Consolidated net debt had decreased by `1,492

cr. to `20,619 compared to Mar’19. Net debt/EBIDTA as of sept’19 is 2.0x.

Increase in Capacity: The board has approved 3.4mt capacity expansion in

Eastern India to be completed by Q4FY21 at a capex of `940cr. During Jan-

March period Ultratech’s plants runs at 110% of capacity in eastern India.

Century Cement: Century Cement utilization dropped to 48% for the quarter as

compared to 64% in Q2FY19. Utilization ratio decreased as there was plant

shutdown for 16 days. Management guided that within next 12 months Century

should be in line with Ultratech utilization ratio & EBIDTA/tonne. Management

guided out of 14.6 MMTPA capacity of Century, 12.6 will be sold in the name of

Ultratech by upcoming December 2019.

Outlook and Valuation: We are positive on the long term prospects of the

Company given ramp up from acquired capacities, pricing discipline in the

industry and benign energy & freight costs. Synergy benefit is yet to play out for

the inorganic expansion of JP associates, Binani & Century cement. We maintain

our “Buy” recommendation on Ultratech by valuing it at 15x FY21E EV/EBIDTA to

arrive at a target price of `4984.

Key Financials

Y/E March ( ` cr)

FY18

FY19

FY20E

FY21E

Net Sales

30,978.6

37,379.2

43,916.1

47,482.1

% chg

22.1

20.7

17.5

8.1

Net Profit

2,224.6

2,431.1

4,050.9

4,670.3

% chg

-18.0

9.3

66.6

15.3

EBITDA (%)

19.8

18.2

22.3

22.7

EPS (Rs)

80.9

88.7

140.4

161.8

P/E (x)

51.5

47.0

29.7

25.8

P/BV (x)

6.0

5.2

4.7

4.3

RoE (%)

8.75

8.89

12.32

11.83

RoCE (%)

10.92

9.58

12.57

12.65

EV/EBITDA

22.1

20.8

14.2

12.5

EV/Sales

4.4

3.8

3.2

2.8

Source: Company Valuation as on closing price as on 01/11/2019

Note: FY20E & FY21E numbers includes Century Cement for full F.Y.

BUY

CMP `4177

Target Price `4984

Investment Period 12 months

Stock Info

Sector

Bloomberg Code

Shareholding Pattern (% )

Promoters

MF / Banks / Indian Fls

FII / NRIs / OCBs

Indian Public / Others

Abs . (% ) 3m 1yr 3yr

Sens ex 3.8 16.5 44.0

Ultraterc h Cement (4.2) 19.0 4.7

61.7

11.9

17.9

8.5

Net Debt (` cr)

Market Cap (` cr)

120,142

20,619

Beta

1.4

52 Week High / Low

4905/3261

Avg. Daily Monthly V olume

543,727

Face V alue (`)

10

BS E Sens ex

40,165

Nifty

11,890

ULTC.NS

Reuters Code

UTCEM:IN

Cement

Price Chart

Source: Company, Angel Research

Research Analyst

Jyoti Roy

+022 39357600, Extn: 6842

jyoti.roy@angelbroking.com

Keshav Lahoti

+022 39357600, Extn: 6363

keshav.lahoti@angelbroking.com

-

1,000

2,000

3,000

4,000

5,000

Nov-16

Jan-17

Apr-17

Jul-17

Oct-17

Jan-18

Apr-18

Jul-18

Oct-18

Jan-19

Apr-19

Jul-19

Oct-19

Ultratech Cement

Performance Update

Q2FY2020 Result Update | Cement

November 2, 2019

2

Ultratech Cement | Q2FY2020 Result Update

November 2, 2019

2

Exhibit 1: Q2FY20 Performance

Y/E March (` cr)

Q 2FY20

Q 2Y19

% yoy

Q 1FY20

% qoq

FY2020E

FY2019

% chg

Net Sales

9620.5

9249.3

4.0

11404.9

-15.6

43916.1

37379.2

17.5

Cost of Materials Consumed

1523.8

1393.0

9.4

1614.4

-5.6

7061.0

6527.1

8.2

(% of Sales)

15.8

15.1

14.2

16.1

17.5

Employee Benefit Expense

638.4

603.8

5.7

596.0

7.1

2436.5

2058.8

18.3

(% of Sales)

6.6

6.5

5.2

5.5

5.5

Power & Fuel

1965.8

2265.0

-13.2

2344.6

-16.2

9084.6

8427.9

7.8

(% of Sales)

20.4

24.5

20.6

20.7

22.5

Freight & Forw arding Expense

2115.5

2281.0

-7.3

2520.3

-16.1

9816.5

8846.7

11.0

(% of Sales)

22.0

24.7

22.1

22.4

23.7

Other Expenses

1459.0

1285.3

13.5

1379.6

5.8

5704.9

4730.5

20.6

(% of Sales)

15.2

13.9

12.1

13.0

12.7

Total Expenditure

7702.4

7828.1

-1.6

8454.9

-8.9

34103.6

30591.0

11.5

Operating Pr ofit

1918.1

1421.2

35.0

2950.0

-35.0

9812.5

6788.2

44.6

OPM margin

19.9

15.4

25.9

22.3

18.2

Interest

507.1

416.4

21.8

502.8

0.9

1715.1

1548.5

10.8

Depreciation

668.4

624.0

7.1

688.4

-2.9

2766.6

2139.8

29.3

Other Income

153.7

142.8

7.6

134.2

14.6

540.0

438.0

PBT (excl. Ext Items)

896.2

523.6

71.2

1893.0

-52.7

5870.8

3537.9

65.9

Exceptional item (Income)/Expense

6.2

0.0

0.0

0.0

0.0

0.0

0.0

Share of profit/ (loss) of associates & JV

-0.2

0.4

0.4

PBT (incl. Ext Items)

889.8

523.6

69.9

1893.0

-53.0

5870.8

3537.9

65.9

(% of Sales)

9.2

5.7

16.6

13.4

9.5

Provision for Taxation

311.3

167.7

611.8

1819.9

1106.8

Taxation pertaining to earlier years

0.0

0.0

0.0

0.0

0.0

(% of PBT)

35.0

32.0

32.3

31.0

31.3

Reported PAT

578.6

355.9

62.6

1281.2

-54.8

4050.9

2431.1

66.6

Adjusted PAT

578.6

355.9

1281.2

4050.9

2431.1

PATM

6.0

3.8

11.2

9.2

6.5

Source: Company, Angel Research

Note: Except FY19 all numbers includes Century Cement for full F.Y.

3

Ultratech Cement | Q2FY2020 Result Update

November 2, 2019

3

Downside risks to our estimates

Demand not picking up as expected.

Reduced Infrastructure spends by G overnment.

Increase in supply.

Delay in syner gy benefits from inorganic expansion.

4

Ultratech Cement | Q2FY2020 Result Update

November 2, 2019

4

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2018

FY2019

FY2020E

FY2021E

Revenue

30,978.6

37,379.2

43,916.1

47,482.1

% chg

22.1

20.7

17.5

8.1

Total Expenditure

24,833.5

30,591.0

34,103.6

36,699.3

Cost of Materials Consumed

5,288.8

6,527.1

7,061.0

7,634.4

Employee Benefit Expense

1,810.2

2,058.8

2,436.5

2,608.5

Power & Fuel

6,334.1

8,427.9

9,084.6

9,822.3

Freight & Forw arding Expense

7,310.0

8,846.7

9,816.5

10,405.5

Other Expenses

4,090.4

4,730.5

5,704.9

6,228.7

EBITDA

6,145.1

6,788.2

9,812.5

10,782.8

% chg

17.9

10.5

44.6

9.9

(% of Net Sales)

19.8

18.2

22.3

22.7

Depreciation& Amortisation

1,847.9

2,139.8

2,766.6

3,046.1

EBIT

4,297.2

4,648.4

7,045.9

7,736.6

% chg

11.2

8.2

51.6

9.8

(% of Net Sales)

13.9

12.4

16.0

16.3

Interest & other Charges

1,237.6

1,548.5

1,715.1

1,518.0

Other Income

588.6

438.0

540.0

550.0

(% of PBT)

16.1

12.4

9.2

8.1

Recurring PBT

3,648.2

3,537.9

5,870.8

6,768.6

% chg

(5.8)

(3.0)

65.9

15.3

Exceptional Ite ms

(346.6)

-

-

-

Tax

1,077.0

1,106.8

1,819.9

2,098.3

Current & deferred tax

1,077.0

1,106.8

1,819.9

2,098.3

Taxation pertaining to earlier years

-

-

-

-

(% of PBT)

29.5

31.3

31.0

31.0

PAT (reported)

2,224.6

2,431.1

4,050.9

4,670.3

ADJ. PAT

2,571.2

2,431.1

4,050.9

4,670.3

% chg

(5.2)

(5.4)

66.6

15.3

(% of Net Sales)

8.3

6.5

9.2

9.8

Basic EPS (Rs)

80.9

88.7

140.4

161.8

Fully Diluted EPS (Rs)

80.8

88.7

140.4

161.8

% chg

(18.3)

9.7

58.3

15.3

Source: Company, Angel Research

Note: FY20E & FY21E numbers includes Century Cement for full F.Y.

5

Ultratech Cement | Q2FY2020 Result Update

November 2, 2019

5

Exhibit 2: Consolidated Balance Sheet

Y/E March (` cr)

FY2018

FY2019

FY2020E

FY2021E

SOURCES OF FUNDS

Equity Share Capital

274.6

274.6

288.6

288.6

Reserves& Surplus

26,106.6

28,114.3

37,089.5

41,325.8

Shareholders Funds

26,381.2

28,388.9

37,378.1

41,614.4

Minority Interest

16.0

12.2

10.9

10.2

Total Debt

19,480.2

22,818.4

23,536.4

19,836.4

Other Liabilities

191.7

172.5

189.7

208.7

Net Deferred tax

3,173.3

3,541.8

4,187.6

4,932.2

Total Liabilities

49,242.4

54,933.7

65,302.6

66,601.7

APPLICATION OF FUNDS

Gross Block

43,045.5

49,715.3

58,778.3

60,678.3

Less: Acc. Depreciation

4,366.5

6,426.6

8,141.7

9,659.8

Net Block

38,679.0

43,288.7

50,636.6

51,018.6

Capit al Work-in-Progre ss

1,511.2

1,122.1

1,180.0

1,210.0

Goodwill on Consolidation

1,036.3

2,847.1

2,847.1

2,847.1

Non current Investments

1,497.9

1,405.3

1,500.0

1,550.0

Other non-current assets

2,955.5

4,105.7

4,800.0

5,500.0

Current Assets

11,461.2

11,754.7

15,341.8

16,576.7

Investment

3,949.0

1,516.0

3,700.0

3,750.0

Inventories

3,267.6

3,585.1

3,830.8

4,102.3

Sundry Debtors

2,220.6

2,531.4

2,767.3

2,992.0

Cash & Bank Balance

219.1

707.2

928.7

1,217.4

Loans & Advances

1,804.9

3,415.0

4,115.0

4,515.0

Current liabilities

7,898.7

9,589.9

11,002.9

12,100.7

Net Current Assets

3,562.5

2,164.8

4,338.9

4,476.0

Total Assets

49,242.4

54,933.7

65,302.6

66,601.7

Source: Company, Angel Research

Note: FY20E & FY21E numbers includes Century Cement for full F.Y.

6

Ultratech Cement | Q2FY2020 Result Update

November 2, 2019

6

Exhibit 3: Consolidated Cash Flow

Y/E March (` cr)

FY2018

FY2019

FY2020E

FY2021E

Net Profit

3,301.5

3,538.4

5,870.8

6,768.6

Depreciation

1,847.9

2,139.8

2,766.6

3,046.1

Interest

1,171.5

1,454.1

1,715.1

1,518.0

Change in Working Capital

(1,255.4)

(937.4)

(951.9)

(758.2)

Others

(334.9)

(324.9)

-

-

Taxes paid

(842.9)

(710.1)

(1,174.2)

(1,353.7)

Cash Flow from Operations

3,887.7

5,159.9

8,226.5

9,220.9

(Inc.)/ Dec. in Fixed Assets

(1,876.6)

(1,503.9)

(2,100.0)

(3,458.1)

(Inc.)/ Dec. in Investments

3,742.3

2,749.1

(2,818.7)

(650.0)

Cash Flow from Inve sting

1,865.7

1,245.2

(4,918.7)

(4,108.1)

Issue of Equity

15.7

5.2

-

-

Inc./(Dec.) in borrowings

6,479.7

(4,137.7)

(1,800.0)

(3,700.0)

Dividend(includind DDt)

(334)

(346)

(400)

(435)

Interest paid

(1,210)

(1,484)

(1,715)

(1,518)

Others

(10,687)

(83)

540

550

Cash Flow from Financing

(5,735.1)

(6,045.0)

(3,375.1)

(5,102.8)

Inc./(Dec.) in Cash

18.4

360.1

(67.3)

10.0

Opening Cash balances

58.8

77.2

437.2

370.0

Closing Cash balances

77.2

437.2

370.0

380.0

Source: Company, Angel Research

Note: FY20E & FY21E numbers includes Century Cement for full F.Y.

Exhibit 4: Key Ratios

Y/E March

FY2018

FY2019

FY2020E

FY2021E

Valuati on Ratio (x)

P/E (on FDEPS)

51.5

47.0

29.7

25.8

P/CEPS

25.8

23.2

16.1

14.2

P/BV

6.0

5.2

4.7

4.3

Dividend yield (%)

0.0

0.0

0.0

0.0

EV/Sales

4.4

3.8

3.2

2.8

EV/EBITDA

22.1

20.8

14.2

12.5

EV / Total Assets

9.6

9.4

7.5

6.7

Per Share Data (Rs)

EPS (Basic)

80.9

88.7

140.4

161.8

EPS (fully diluted)

80.8

88.7

140.4

161.8

Cash EPS

161.4

179.9

258.6

293.2

DPS

10.0

10.5

11.5

12.5

Book Value

693.9

799.7

888.6

960.7

Returns (%)

ROE

8.8

8.9

12.3

11.8

ROCE

10.9

9.6

12.6

12.6

Angel ROIC (Pre tax)

14.4

11.4

14.9

15.2

Source: Company, Angel Research (Valuation done as on 1/11/19)

Note: FY20E & FY21E numbers includes Century Cement for full F.Y.

7

Ultratech Cement | Q2FY2020 Result Update

November 2, 2019

7

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 v ide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / m anaged or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any in vestment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding po sitions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other rel iable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any wa y

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cann ot

testify, nor make any representation or warranty, express or implied, to the a ccuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may b e

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduc ed,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement Inox Leisure

1. Financial interest of research analyst or Angel or his Associate or his relative No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives No

3. Served as an officer, director or employee of the company covered under Research No

4. Broking relationship with company covered under Research No

Ratings (Based on Expected Returns: Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

Over 12 months investment period) Reduce (-5% to -15%) Sell (< -15%)

Hold (Fresh purchase not recommended)